The module introduces stochastic processes, principles of actuarial modelling and time series models and analysis.

On completion of the course students should be able to (learning outcomes):

- Understand concepts of stochastic processes;

- Understand properties of Markov chain models for discrete-state processes;

- Understand applications of Poisson processes;

- Understand basic concepts to model and to analyse time series

Syllabus:

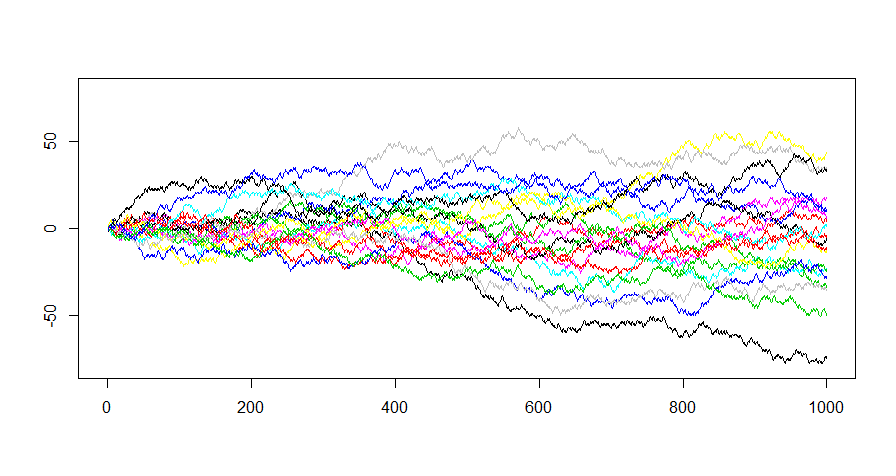

Stochastic processes

General stochastic process models. Random walks. Reflecting and absorbing barriers. Mean recurrence time, mean time to absorption. Difference equations. Markov chain models for discrete-state processes. Transition matrices: 1-step and n-step. Classification of states. Equilibrium distributions for time-homogeneous chains. Detail balance, general balance, limiting distribution, stationary distribution. Poisson processes.

Time series

Time series models; trend and seasonality. Stationarity. Autocovariance, autocorrelation and partial autocorrelation functions. Correlograms. Autoregressive (AR) processes. Moving average (MA) processes. ARMA processes. ARIMA processes and Box-Jenkins methods. Forecasting and minimising expected prediction

variance. Introduction to frequency domain analysis. Spectral density function. Periodograms.

- Module Supervisor: Igor Rodionov