The aim of the Contingencies I module is to provide a grounding in the mathematical techniques which can be used to model and value cashflows dependent on death, survival or other uncertain risks. This module covers the initial part of the Institute and Faculty of Actuaries CT5 syllabus (Contingencies, Core Technical).

Syllabus

1. Functions for one life

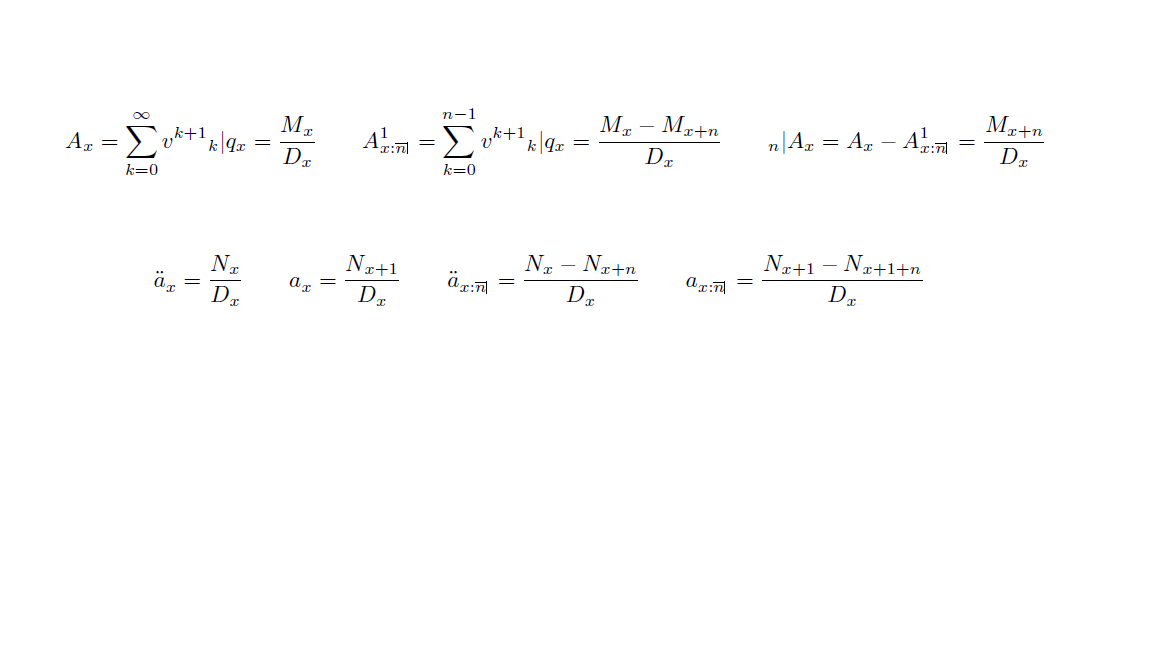

Define and use straightforward functions involving only one life. In respect of these functions: define assurance and annuity contracts and develop formulae for the means and variances of the present value of the benefits under the contracts [CT5-(i)].

2. Evaluation of means and variances

Develop practical methods of evaluating expected values and variances of contracts [CT5-(ii)].

3. Net premiums and reserves

Describe and calculate net premiums and net premium reserves [CT5-(iii)].

4. Changing benefits.

Describe the calculation of net premiums and net premium reserves for increasing and decreasing benefits [CT5-(iv)].

5. Gross premiums and reserves.

Describe and calculate gross premiums and gross premium reserves [CT5-(v)].

Learning Outcomes

On completion of this module, students should be able to:

* Define simple assurance and annuity contracts, and develop formulae for the means and variances of the present values of the payments under these contracts, assuming constant deterministic interest.

* Describe practical methods of evaluating expected values and variances of the simple assurance and annuity contracts.

* Describe and calculate, using ultimate or select mortality, net premiums and net premium reserves of simple assurance and annuity contracts.

* Describe the calculation, using ultimate or select mortality, of net premiums and net premium reserves for increasing and decreasing benefits and annuities.

* Describe the calculation of gross premiums and reserves of assurance and annuity contracts.

- Module Supervisor: Jackie Wong Siaw Tze